Nexo has emerged as one of the leading platforms, providing a range of services for crypto enthusiasts. In the ever-evolving world of cryptocurrency, platforms that offer secure, efficient, and user-friendly services are essential for both beginners and experienced traders.

From earning interest on digital assets to taking out loans against your cryptocurrency, Nexo offers multiple features designed to simplify the way you interact with crypto.

In this Nexo review, we’ll take an in-depth look at what the platform has to offer, exploring its features, security measures, fees, and more. Whether you’re considering using Nexo for crypto lending, borrowing, or earning interest, this review will help you make an informed decision.

What is Nexo?

Nexo is a cryptocurrency platform that offers a wide range of financial services, including earning interest on digital assets, taking out loans using crypto as collateral, and trading various cryptocurrencies. Founded in 2018, Nexo aims to bridge the gap between traditional finance and the rapidly growing world of digital currencies.

With Nexo, users can earn up to 12% annual interest on their crypto holdings, access instant crypto-backed loans, and use the platform’s native NEXO token for added benefits. Nexo operates globally and is regulated in several jurisdictions, making it a trusted choice for cryptocurrency investors looking to maximize their returns and access liquidity without selling their assets.

This Nexo review will dive deeper into how the platform works and what makes it a unique player in the crypto finance space.

Features of Nexo

Nexo offers a variety of features designed to make managing cryptocurrency easier and more rewarding for its users. These features cater to both beginners and seasoned crypto investors, providing multiple ways to earn, borrow, and trade. Here are some of the key features of the platform:

Crypto Interest Accounts

One of the standout features of Nexo is the ability to earn interest on your cryptocurrency holdings. By depositing digital assets like Bitcoin, Ethereum, and stablecoins into your Nexo account, you can earn interest up to 12% annually. Interest is paid daily, allowing you to see your rewards accumulate in real-time.

Instant Crypto-Backed Loans

Nexo also allows users to take out loans using their crypto as collateral. The platform offers instant, low-interest loans without the need to sell your assets. This feature is especially valuable for those who want liquidity but prefer to hold onto their cryptocurrency investments.

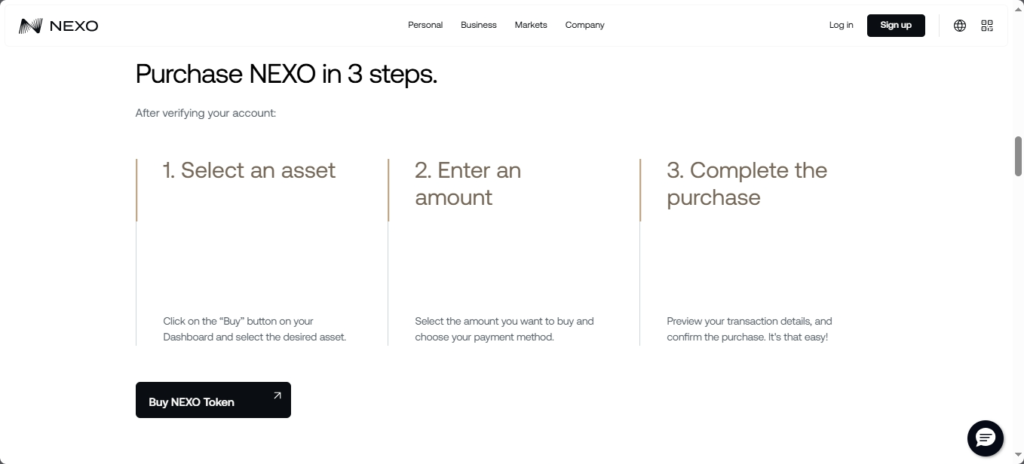

Nexo Token (NEXO)

Nexo offers its own native token, NEXO, which can be used to unlock additional benefits on the platform. Holding NEXO tokens allows users to earn higher interest rates, access lower loan rates, and participate in profit-sharing opportunities. The token can also be traded on various exchanges.

Staking Options

For those interested in a more hands-on approach to earning rewards, Nexo provides staking options for selected cryptocurrencies. Staking allows you to earn additional tokens by participating in the network’s security and operations.

User-Friendly Interface

Nexo’s platform is designed with simplicity in mind. Whether you’re using the web platform or the mobile app, navigating through various services like earning interest, borrowing, or exchanging cryptocurrencies is straightforward.

Security Features

Nexo employs top-tier security measures to protect user assets. These include two-factor authentication (2FA), insurance coverage for digital assets, and regular security audits to ensure the platform’s safety.

These are just a few of the many features that make Nexo a powerful platform for managing and growing your cryptocurrency portfolio. Whether you’re looking to earn interest or access liquidity, Nexo offers a comprehensive suite of services to meet your needs.

Security and Safety

When it comes to managing digital assets, security is a top priority, and Nexo takes this responsibility seriously. The platform offers a range of advanced security features designed to protect your funds and personal information from unauthorized access and potential threats.

Two-Factor Authentication (2FA)

To enhance account protection, Nexo requires users to enable two-factor authentication (2FA) for login and transactions. This additional layer of security ensures that even if someone gains access to your account credentials, they cannot complete any actions without the second verification step.

Insurance Coverage

Nexo has partnered with trusted custodians like BitGo and maintains insurance coverage to protect digital assets stored on the platform. This coverage helps safeguard your funds in the event of a breach or theft, offering added peace of mind to users.

Cold Storage and Multi-Signature Technology

A significant portion of user funds is stored in cold wallets (offline storage), which are less vulnerable to hacking attempts compared to hot wallets. Additionally, Nexo uses multi-signature technology for an extra layer of protection, ensuring that multiple parties are required to authorize any transaction involving your assets.

Regular Security Audits

To further ensure the platform’s security, Nexo undergoes regular security audits by external experts. These audits help identify potential vulnerabilities, ensuring that the platform adheres to the highest standards of security.

Compliance with Industry Standards

Nexo complies with the industry’s best practices and follows stringent Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations. This commitment to legal compliance adds an extra level of credibility and security for users around the globe.

With these robust security measures in place, Nexo aims to provide a safe environment for users to manage their crypto assets. Whether you’re earning interest, borrowing, or simply storing your crypto, you can trust that Nexo prioritizes the security and safety of your funds.

Fees and Charges

When using any cryptocurrency platform, understanding the fees and charges is crucial to avoid unexpected costs. Nexo aims to provide transparency in its fee structure, ensuring users are well-informed about the costs associated with its services. Here’s a breakdown of the key fees and charges you may encounter on the platform:

Deposit Fees

One of the advantages of using Nexo is that there are no fees for depositing cryptocurrency into your account. You can easily transfer assets like Bitcoin, Ethereum, and stablecoins to your Nexo wallet without any additional charges.

Withdrawal Fees

Nexo does not charge a fee for withdrawing funds to an external wallet. However, some blockchain networks, such as Bitcoin or Ethereum, may require a network fee, which is determined by the blockchain itself and not by Nexo.

Transaction Fees

For trading or exchanging cryptocurrencies on the Nexo platform, transaction fees apply. These fees are typically competitive within the industry, but they may vary depending on the type of trade and the currencies involved.

Loan Fees

When taking out a loan using your crypto as collateral, Nexo charges an interest rate based on the loan-to-value (LTV) ratio. Interest rates for loans vary depending on the type of crypto used as collateral and the length of the loan. However, Nexo provides a low-cost, flexible loan structure compared to traditional financial institutions.

Early Repayment Fees

If you decide to repay your crypto-backed loan early, Nexo does not charge any penalties or fees, making it easier to manage your finances and reduce your debt without additional costs.

NEXO Token Benefits

By holding Nexo’s native token, NEXO, you can enjoy reduced fees across the platform, including lower interest rates on loans and better rates for trading and withdrawals. Holding NEXO tokens also allows you to receive a portion of the platform’s profits, which can further offset any costs you may incur.

Overall, Nexo strives to keep fees competitive and transparent, making it a cost-effective platform for both crypto investors and borrowers. With no deposit fees, flexible withdrawal options, and low-cost loans, Nexo stands out as an attractive option for users seeking a reliable and affordable crypto platform.

Mobile App

The Nexo mobile app brings the platform’s powerful features to your fingertips, allowing users to manage their cryptocurrency assets and transactions on the go. Available for both iOS and Android devices, the app is designed for ease of use and functionality, making it a convenient tool for crypto enthusiasts.

Easy Navigation

The Nexo mobile app offers a user-friendly interface that makes it easy to navigate between features like earning interest, accessing loans, and managing your portfolio. Whether you’re new to cryptocurrency or an experienced user, the app ensures a smooth and intuitive experience.

Instant Access to Crypto-Backed Loans

With the mobile app, you can access Nexo’s instant crypto-backed loans anytime, anywhere. Whether you need liquidity or want to take advantage of market opportunities, you can apply for loans using your crypto as collateral with just a few taps.

Real-Time Interest Tracking

The app allows you to track the interest you’re earning on your digital assets in real-time. You can easily see how your crypto holdings are growing and adjust your strategy as needed.

Secure Transactions

The Nexo mobile app supports all the same robust security measures as the desktop version, including two-factor authentication (2FA) and biometric login options, ensuring that your funds and personal information are protected.

Push Notifications

Stay updated with real-time notifications about your portfolio, market trends, and account activity. The app sends you alerts about interest payments, loan updates, and important platform news, keeping you informed at all times.

Compatibility

The Nexo mobile app is compatible with both iOS and Android devices, making it accessible to a wide range of users. It is available for download from the App Store and Google Play Store.

Overall, the Nexo mobile app offers a comprehensive and secure way to manage your cryptocurrency portfolio on the go. Whether you’re looking to earn interest, take out loans, or simply keep track of your investments, the app provides a convenient and reliable solution.

Nexo Token (NEXO)

The Nexo Token (NEXO) is the native cryptocurrency of the Nexo platform, offering users a variety of benefits and utility within the ecosystem. NEXO is an ERC-20 token built on the Ethereum blockchain, and it plays a central role in enhancing the experience for those who use Nexo for earning interest, borrowing, and trading digital assets.

Benefits of Holding NEXO

Holding NEXO tokens provides several advantages on the platform. Users can unlock higher interest rates on their crypto holdings, enjoy lower fees on loans, and access exclusive rewards. Additionally, NEXO token holders receive a share of the platform’s profits, which is distributed in the form of dividends, making it an attractive option for long-term investors.

NEXO for Lower Loan Interest Rates

One of the key benefits of holding NEXO tokens is the ability to reduce loan interest rates. By using NEXO as collateral, users can access better loan terms and lower the cost of borrowing from Nexo. This feature is particularly useful for those who frequently use crypto-backed loans.

Earning Dividends

NEXO holders are eligible to receive dividends, which are paid out based on the platform’s profits. This creates an additional revenue stream for token holders, making NEXO a valuable asset for those who want to benefit from the success of the platform.

Trading NEXO

NEXO tokens can also be traded on various cryptocurrency exchanges, providing liquidity and flexibility for those who wish to buy, sell, or trade the token. This makes NEXO not only a utility token on the platform but also an asset with its own market value.

Staking NEXO

For users who want to maximize their returns, Nexo offers the option to stake NEXO tokens. Staking allows users to earn additional rewards and interest on their holdings while also contributing to the platform’s governance and growth.

The Nexo Token (NEXO) is more than just a utility token; it offers a range of benefits that can enhance the overall experience on the platform. Whether you’re looking for reduced loan rates, higher interest earnings, or additional rewards, holding NEXO tokens can help you get the most out of your Nexo experience.

Nexo’s Interest Rates

One of the key features that sets Nexo apart from other cryptocurrency platforms is its competitive interest rates, offering users the opportunity to earn attractive returns on their digital assets. Whether you’re looking to earn passive income or maximize the growth of your crypto holdings, Nexo’s interest rates provide a valuable way to put your assets to work.

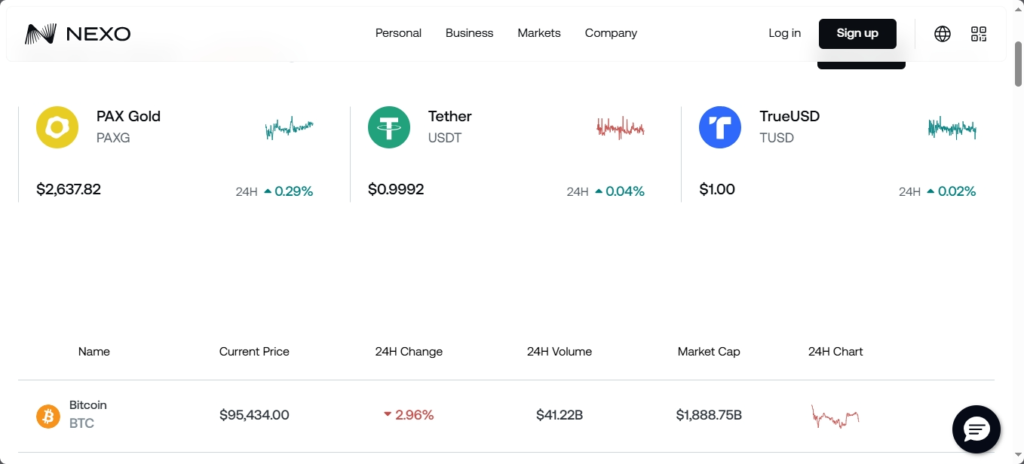

Earning Interest on Crypto Assets

With Nexo, users can earn interest on a wide range of cryptocurrencies, including Bitcoin, Ethereum, stablecoins, and many others. The interest rates vary depending on the type of asset you deposit and whether you choose to receive your interest in NEXO tokens or the underlying cryptocurrency.

Interest rates can reach up to 12% annually, with stablecoins often offering higher returns compared to more volatile cryptocurrencies. The interest is paid daily, allowing you to track your earnings in real-time.

Interest Rate Boost with NEXO Tokens

To further enhance the interest rates, Nexo offers users the ability to increase their earnings by holding NEXO tokens. By holding a certain amount of NEXO tokens in your account, you can unlock higher interest rates, making it a great option for long-term investors who want to maximize their returns.

Flexible Payment Options

Nexo provides flexibility when it comes to how you receive your interest payments. Users can choose to receive their interest in NEXO tokens or the cryptocurrency they deposited. Opting for NEXO tokens often results in higher interest rates, while receiving interest in the same crypto asset allows for more stable returns.

Comparing Interest Rates to Competitors

Compared to other crypto platforms, Nexo’s interest rates are highly competitive, especially when it comes to stablecoins and popular cryptocurrencies. The platform’s rates are generally higher than traditional banks, making it an attractive option for those looking to earn a passive income on their digital assets.

Interest Rates for Loans

In addition to earning interest on deposits, Nexo also offers competitive rates on crypto-backed loans. Loan interest rates depend on the asset used as collateral and the loan-to-value (LTV) ratio. The more NEXO tokens you hold, the lower the interest rate on loans, further incentivizing users to engage with the platform.

Overall, Nexo’s interest rates are designed to provide users with an excellent opportunity to grow their cryptocurrency holdings while benefiting from flexibility, security, and competitive returns. Whether you’re looking to earn on your assets or take out a loan, Nexo offers some of the most attractive rates in the crypto industry.

Nexo Loan System

The Nexo loan system offers a unique and convenient way for cryptocurrency holders to access liquidity without the need to sell their assets. This feature allows users to borrow funds against their crypto holdings, providing a fast and flexible alternative to traditional loans. Whether you need funds for personal use, investment opportunities, or other expenses, Nexo’s loan system makes it easy to tap into the value of your cryptocurrency.

How Nexo Loans Work

Nexo’s loan system works by allowing users to deposit their cryptocurrencies as collateral. Once your collateral is deposited, you can instantly access a loan based on the value of your crypto assets. The loan amount typically ranges from 50% to 90% of the value of your collateral, depending on the type of cryptocurrency used.

Unlike traditional loans, which often require a lengthy approval process, Nexo loans are processed instantly. Once approved, the funds are deposited into your account, and you can access them immediately.

Loan-to-Value (LTV) Ratio

The loan-to-value (LTV) ratio is an important factor in determining how much you can borrow. Nexo’s loan system offers competitive LTV ratios, allowing you to borrow a substantial percentage of your collateral’s value. For example, the LTV ratio for stablecoins can be as high as 90%, while Bitcoin and other more volatile assets may have a lower LTV ratio.

Flexible Repayment Terms

One of the key advantages of Nexo loans is the flexibility in repayment terms. Users can choose between short-term and long-term loan options. There are no penalties for early repayment, allowing you to pay off your loan whenever it is convenient for you.

Additionally, Nexo offers flexible interest rates depending on the amount of NEXO tokens you hold. The more NEXO tokens you possess, the lower the interest rate on your loan, making it a great option for users who want to minimize the cost of borrowing.

No Credit Checks or Income Verification

Unlike traditional financial institutions, Nexo’s loan system does not require credit checks or income verification. This means that even if you have a limited credit history or non-traditional income sources, you can still access a loan as long as you have sufficient crypto collateral.

Crypto-Backed Loans for Various Purposes

Whether you need funds for personal use, business investments, or to take advantage of market opportunities, Nexo loans can be used for a wide range of purposes. Since the loans are backed by your crypto assets, there are no restrictions on how you use the borrowed funds.

Repayment and Interest Rates

Nexo’s loan system offers competitive interest rates, with rates starting as low as 5.9% annually. The platform also allows users to repay their loans at any time without penalty. If you hold NEXO tokens, you can further reduce your loan interest rates, making borrowing even more affordable.

In summary, Nexo’s loan system provides a fast, flexible, and secure way to access funds without the need to sell your cryptocurrency. With competitive LTV ratios, low-interest rates, and no credit checks, Nexo offers a unique solution for those looking to leverage their crypto assets for financial liquidity.

Pros and Cons of Nexo

When considering a platform for managing and leveraging your cryptocurrency assets, it’s essential to weigh the pros and cons. Nexo offers a wide range of features, but like any service, it has both advantages and drawbacks. Here’s a detailed look at the pros and cons of Nexo to help you decide if it’s the right choice for your crypto needs.

Pros of Nexo

1. Competitive Interest Rates

One of the major benefits of using Nexo is its competitive interest rates on crypto deposits. Users can earn up to 12% annually, depending on the type of cryptocurrency deposited. Stablecoins, in particular, offer some of the highest returns on the platform.

2. Instant Crypto-Backed Loans

Nexo’s loan system allows you to access funds instantly by using your cryptocurrency as collateral. This provides flexibility and liquidity without having to sell your assets, making it an excellent option for those who need quick access to cash.

3. No Credit Checks or Income Verification

Unlike traditional financial institutions, Nexo does not require credit checks or income verification to access loans. This makes it accessible to a wider audience, particularly those who may not qualify for traditional loans due to a lack of credit history.

4. Security Features

Nexo places a strong emphasis on security, employing measures such as two-factor authentication (2FA), cold storage for crypto assets, and insurance coverage. These steps help ensure your funds are safe and protected from potential threats.

5. NEXO Token Benefits

By holding Nexo’s native token, NEXO, users can unlock additional benefits, including higher interest rates, lower loan interest rates, and access to platform profits through dividends. This adds an extra layer of value for token holders.

6. User-Friendly Mobile App

The Nexo mobile app allows users to manage their assets, earn interest, and access loans from anywhere. With its intuitive interface and real-time updates, the app makes it easy to keep track of your crypto portfolio and finances.

Cons of Nexo

1. Fees for Trading and Withdrawals

While depositing crypto into Nexo is free, there are transaction fees associated with trading and withdrawing funds. These fees may vary depending on the type of transaction, which could be a drawback for users looking for completely free services.

2. Limited Cryptocurrencies

Although Nexo supports a variety of cryptocurrencies, its selection is still more limited compared to some other platforms. If you’re looking to trade or earn interest on less common tokens, you may need to look elsewhere.

3. High Interest Rates for Some Loans

While Nexo offers competitive loan interest rates, the rates can be relatively high for certain cryptocurrencies, especially those with higher volatility. Users may need to hold NEXO tokens to access the best loan terms, which might not be ideal for everyone.

4. Centralized Platform

As a centralized platform, Nexo requires users to trust the company with their funds, which can be a concern for individuals who prioritize decentralized finance (DeFi). Centralized platforms are also more vulnerable to regulatory changes.

5. Withdrawal Limits

Nexo has withdrawal limits for both fiat and crypto transactions, which could be restrictive for high-volume traders or users who need to withdraw large amounts of assets quickly.

Conclusion

The pros and cons of Nexo highlight its strengths in offering competitive interest rates, fast loan access, and strong security. However, the platform does have limitations such as trading fees, a limited selection of cryptocurrencies, and centralized operations. Weighing these factors against your specific needs will help you determine if Nexo is the right platform for managing and growing your cryptocurrency assets.

Nexo vs Competitors

When choosing a platform to manage your cryptocurrency assets, it’s essential to compare options to ensure you select the one that best fits your needs. Nexo is a leading player in the crypto lending and interest-earning space, but there are several competitors offering similar services. Here’s a comparison between Nexo and its competitors to help you make an informed decision.

Nexo vs Celsius

Celsius is one of the biggest competitors to Nexo in the crypto lending and earning space. Both platforms allow users to earn interest on their crypto deposits and access crypto-backed loans, but there are some key differences.

- Interest Rates: Nexo typically offers slightly higher interest rates on crypto deposits, especially for stablecoins. Celsius, however, offers competitive rates as well, and both platforms pay interest weekly.

- Loan-to-Value (LTV) Ratio: Nexo offers an LTV of up to 90%, which is higher than Celsius’s 50%-70% LTV ratio, depending on the collateral.

- Fees: Both platforms charge fees for trading and withdrawals, but Nexo has a more transparent and lower fee structure compared to Celsius, which can sometimes have higher fees for certain transactions.

Nexo vs BlockFi

BlockFi is another major competitor to Nexo, offering similar features, including crypto-backed loans and interest-bearing accounts. However, there are some distinctions between the two.

- Interest Rates: Both Nexo and BlockFi offer competitive interest rates, but Nexo tends to offer slightly better rates for certain cryptocurrencies, particularly stablecoins. BlockFi’s rates are generally lower and vary more frequently based on market conditions.

- Loan Features: Nexo offers a higher LTV ratio (up to 90%) compared to BlockFi, which offers a maximum LTV of 50%. This makes Nexo a better option for those looking to borrow larger amounts based on their collateral.

- Native Token: Nexo has its own token, NEXO, which offers additional benefits such as higher interest rates and lower loan fees. BlockFi does not have a native token, which means users miss out on these extra perks.

Nexo vs YouHodler

YouHodler is another crypto lending platform that competes with Nexo by offering interest on deposits and crypto-backed loans. The two platforms share similar offerings, but there are a few differences.

- Interest Rates: YouHodler offers competitive interest rates, but Nexo generally has higher rates on more popular cryptocurrencies, especially for stablecoins.

- Loan-to-Value (LTV) Ratio: Nexo offers up to 90% LTV on crypto-backed loans, which is significantly higher than YouHodler’s 80% LTV. This makes Nexo a better option for users seeking larger loan amounts.

- Fees: YouHodler tends to have higher fees for certain services like withdrawals and trading compared to Nexo, which has a more competitive fee structure.

Nexo vs Binance Earn

Binance Earn is part of Binance, one of the largest cryptocurrency exchanges in the world, offering interest-bearing accounts for various cryptocurrencies. When compared to Nexo, there are a few differences:

- Interest Rates: While Binance Earn offers competitive interest rates, Nexo tends to offer higher rates on a broader range of assets, especially stablecoins.

- Platform Scope: Nexo is a specialized platform focusing primarily on lending and interest-earning features, while Binance Earn is part of the larger Binance ecosystem. This means Nexo may offer a more focused user experience for those looking to manage crypto assets specifically for earning interest or accessing loans.

- Loan Features: Binance Earn does not offer crypto-backed loans in the same way Nexo does. If you’re looking for liquidity through loans, Nexo is the more suitable option.

Nexo vs Crypto.com

Crypto.com is a major competitor to Nexo, offering a wide range of services, including crypto trading, staking, and lending. Here’s how they compare:

- Interest Rates: Nexo offers competitive interest rates, but Crypto.com offers similar or even slightly higher rates in some cases, especially for its own token, CRO. However, Nexo’s rates are more consistent and may offer a better overall return for stablecoin deposits.

- Loan Features: Nexo offers higher LTV ratios (up to 90%) compared to Crypto.com, which typically offers up to 50-70%. This gives Nexo an edge for users looking for larger loan amounts.

- Native Token: Both platforms offer native tokens (NEXO and CRO) that provide additional benefits, such as reduced fees and higher interest rates. Nexo’s token tends to provide more straightforward benefits without the complex staking requirements that Crypto.com has.

Conclusion

In the battle of Nexo vs competitors, each platform has its unique strengths. Nexo stands out with its high LTV ratios, competitive interest rates, and strong security features. While competitors like Celsius, BlockFi, and Crypto.com also offer appealing features,

Nexo is a solid choice for users looking for flexible loans, higher returns on deposits, and the added benefit of the NEXO token. However, depending on your specific needs, platforms like BlockFi or Binance Earn may offer additional services or better rates for certain assets. Ultimately, the right platform for you will depend on your personal preferences and how you plan to use your crypto assets.

Conclusion

In conclusion, Nexo stands out as one of the top platforms for earning interest on cryptocurrency deposits and accessing crypto-backed loans. With its competitive interest rates, high loan-to-value (LTV) ratios, and the added benefits of holding NEXO tokens, it offers users a flexible and secure way to manage their digital assets. Whether you’re looking to grow your crypto holdings passively through interest or need quick access to liquidity without selling your assets, Nexo provides a comprehensive solution.

While Nexo has a few competitors offering similar services, its transparent fee structure, high security measures, and innovative features make it a strong contender in the crypto lending and earning space. However, as with any financial platform, it’s important to consider your specific needs and preferences before making a decision.

If you’re looking for a user-friendly, secure, and efficient platform to maximize the value of your crypto assets, Nexo is certainly worth considering.